|

| Sale & Leaseback |

BVIC has entered into sale and leaseback arrangements for 9 properties, comprising a total of 32,627sqm of lettable area, and 34,739 including storage area. This is BVIC’s largest asset class, that contributed Eur14mm to BVIC’s rental income in 2004 and EUR 128mm to the Group’s sale revenue.

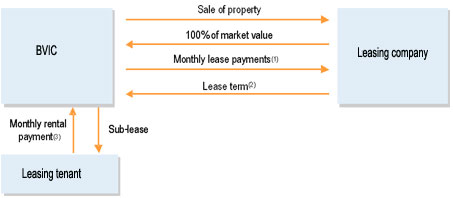

A sale and leaseback agreement is a transaction where the Group sells, a property or part thereof, subject to a lease (normally on institutional terms) for a fixed period of time, usually 10 – 15 years to a Greek leasing company. BVIC will then enter into a typically coterminous occupational lease with a tenant, usually for a period as long as the lease agreement period. The rent received from the tenant is used to pay the interest and amortisation costs to the leasing company. At the end of the lease, BVIC has the right to re-purchase the property, usually at a nominal cost.

The sale and leaseback agreements allow BVIC to transfer the asset’s ownership, while having the right to use or grant sublease of the property. BVIC retains a call option over the properties, so at the end of the lease term, the property may revert to the Group, usually for a nominal fee.

In 2002, Greek tax law was amended so that sale and leaseback transactions were no longer subject to 11% transfer tax. As a result, BVIC had entered into a number of sale & leaseback agreements in respect of its larger, prime location buildings.

In summary, the benefits for BVIC of the sale and lease back structure are that:

- BVIC raises 100% of the market value of the property for the years of the sale & leaseback contract, on entering into the sale and leaseback;

- BVIC may re-purchase the property at the end of the lease term, usually at a nominal value

- no transfer tax (currently at an 11% rate) is payable by the purchaser/leasing company;

- as of 2004, no corporate income tax (currently at 32%) is imposed on any profit derived by BVIC upon its initial sale to the purchaser/leasing company, provided that such a profit or gain is booked in a special tax-free reserve. Such reserve is taxed upon distribution or capitalisation thereof.

The diagram below illustrates how the sale and leaseback process:  | | ¹Typically in the region of EURIBOR + 250bps | | ²Usually coterminous with tenant lease | | ³The annual adjustments is Greek CPI+ (100-200bps) |

Following below, you can view all the BVIC Sales & Leaseback projects. Please click on the names to see a full description of each project.

|

66 Kifisias Ave.

|

Retail, office & storage |

Telecom Italia Mobile (TIM) |

8,207 |

223 |

80,000,000 |

2004-2018 |

|

|

95-97 Kifissias Ave.

|

Retail, office & storage |

Cosmote Mobile Telecom |

6,610 |

1,037 |

50,500,000 |

2004-2017 |

|

|

6 Pouliou Str.

|

Retail, office and storage |

A.S.E.P. |

6,590 |

192 |

27,900,000 |

2003-2015 |

|

|

24 Kifissias Ave.

|

Office & storage |

Marfin Bank |

3,019 |

227 |

20,900,000 |

2002-2014 |

|

|

221 Kifissias Ave.

|

Retail, office & storage |

Microsoft |

2,571 |

128 |

15,000,000 |

2004-2016 |

|

|

1-3 Kifissias Ave.

|

Office & retail |

Ministries of Internal Affairs and Ministry of Puplic Works |

1,992 |

64 |

9,000,000 |

2003-2015 |

|

|

174 Syngrou Ave.

|

Office |

Bestend Publishing |

1,945 |

37 |

5,300,000 |

2003-2015 |

|

|

340 Kifissias Ave.

|

Office |

BVIC S.A. |

1,098 |

155 |

4,000,000 |

2003-2013 |

|

|

109-111 Kifissias Ave.

|

Office & Retail Development |

OTENET |

735 |

|

4,000,000 |

2003-2013 |

|

|

Delta Falirou - Complex II

|

Retail Development |

Media Saturn S.A., Village Roadshow, Giannelos GP |

14,573 |

738 |

49,000,000 |

2006-2019 |

|

|

49 Kifissias Ave.

|

Retail space |

Media Markt, Giannelos |

8,478 |

506 |

20,000,000 |

2005-2017 & 2005-2021 |

|

|